Navigating multistate tax complexities can feel overwhelming. Each state has its own rules, and you might face a maze of regulations. That’s where a CPA in Tomball steps in. They offer guidance through this tangled web. Their deep understanding of diverse tax codes helps you avoid pitfalls. A CPA knows how to manage the challenges of different jurisdictions. They ensure compliance and optimize tax outcomes. You gain a sense of relief knowing someone handles these intricacies for you. A CPA’s expertise helps you avoid costly mistakes. They provide peace of mind as you focus on your goals. With their help, you stay informed about changes in tax laws across states. This proactive approach keeps you ahead of potential issues. Expert CPAs deliver tailored strategies to maximize your benefits. As you navigate multistate tax matters, remember the value of a CPA. Their guidance is your safeguard in this complex terrain.

Understanding State-Specific Regulations

Every state has unique tax laws that can confuse even seasoned business owners. These laws differ in income tax, sales tax, and property tax. A CPA understands these variations and helps you comply. This is crucial to avoid penalties and increase efficiency.

Benefits of CPA Expertise

CPAs provide strategic advice tailored to your specific situation. Their expertise helps you reduce liabilities and identify opportunities. This proactive approach means you are not just complying but benefiting from tax regulations.

Table: State Tax Rates Comparison

| State | Income Tax Rate | Sales Tax Rate |

|---|---|---|

| California | 13.3% | 7.25% |

| Texas | 0% | 6.25% |

| New York | 8.82% | 4.00% |

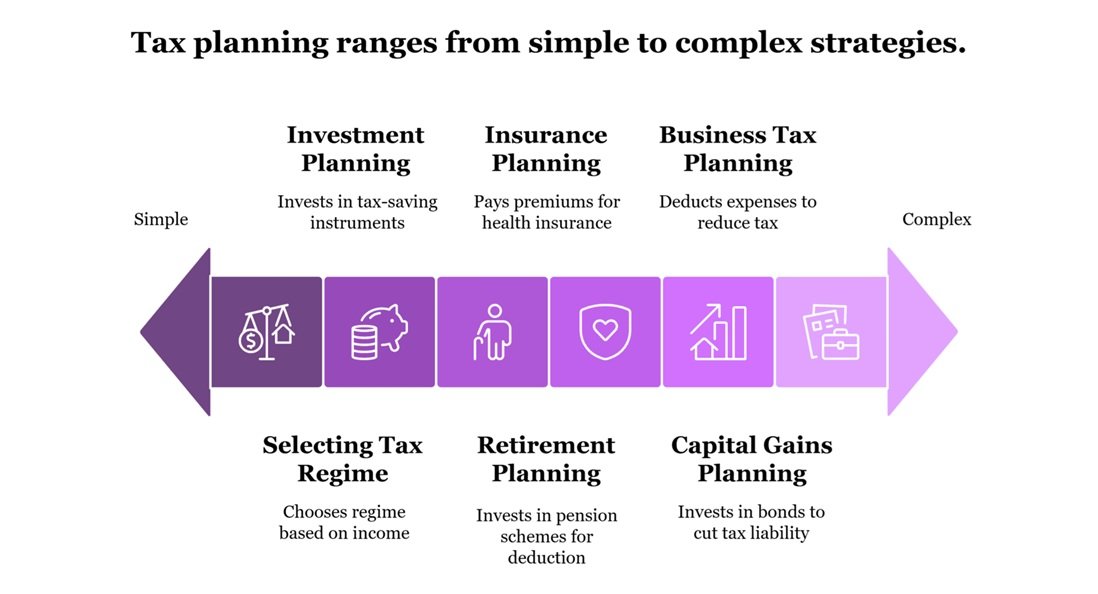

Efficient Tax Planning

Tax planning begins with understanding your liabilities. A CPA analyzes your financial data and pinpoints areas for improvement. Their insights help you make informed decisions. You avoid surprises and manage your finances effectively.

Ensuring Compliance

Ensuring compliance requires awareness of ongoing changes in tax laws. CPAs monitor these changes for you. This means you stay compliant effortlessly. They handle filings, deadlines, and documentation. You focus on growth, knowing compliance is under control.

Access to Resources

Your CPA offers tools and resources that simplify tax management. These include software and online platforms that streamline processes. With these tools, you gain clarity and control over your financial landscape.

Linking with Educational Resources

For further understanding, you can explore resources like the IRS website. They offer insights into federal laws that may affect state taxes. Additionally, the Small Business Administration (SBA) provides guidance on multistate taxation for small businesses.

Conclusion

In conclusion, handling multistate tax matters is not something you should face alone. A CPA stands as your trusted partner, ensuring you navigate this complex terrain smoothly. They offer solutions that save time, money, and stress. By choosing a knowledgeable CPA, you protect your interests and secure your financial future.